30+ Borrowing repayment calculator

Rates locked in for duration of loan. Find out the cost of your monthly loan repayments with our real-time business loan calculator.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

And your salary rise is consistent.

. Its important to note the calculator assumes a fixed rate for the entire life of the loan. After June 30 2021 the percentage rate shifted to. Or if youre ready to apply get started.

Loan repayments are based on the lowest interest rate either standard variable or 3-year fixed rate owner occupier from our lender panel over a repayment period of 30 years. For example after exactly 30 years or 360 monthly payments youll pay off a 30-year mortgage. For borrowings up to 90 including lenders mortgage insurance of the property value.

This calculator estimates your monthly principal and interest or interest only loan repayments but does not include monthly or annual service fees. Your last loan payment will pay off the final amount remaining on your debt. 30 0930 1030 1130 1230.

For example if your lender will allow a 95 ratio the calculator can draw that line for you in addition to the other three. Free calculator to find out the real APR of a loan considering all the fees and extra charges. The borrowing amount is a guide only.

How your income and expenses can impact your borrowing power. ANZ Home Loans are available for periods. You can adjust the variables within the calculator.

For instance if youre borrowing 400000 to buy a 500000 property your LVR would be 80 because 400000 is 80 of 500000. A cash-out refinance term can be up to 30 years. Disclaimer - Borrowing power.

Get an online quote in minutes with Fleximize. Mortgage Calculator exe file - click the link and immediately run the mortgage calculator. Subject to change without notice.

Find out how much you could borrow with our calculator. The home equity line of credit calculator automatically displays lines corresponding to ratios of 80 90 and 100. Repayment terms vary according to lender terms and how much money is borrowed but monthly payments always contain interest obligations.

Based on borrowing at an interest rate of 5 for 25 years your monthly repayments would be. Calculate how much I can save ME N Item - 4 Col c Stamp duty. You can also calculate your monthly repayments and interest rate.

The term youll repay it over and your small business loan rate. Rate applies for new loans when you borrow up to 60 of the property value with a principal and interest repayment variable rate loan. How many years are you borrowing the money for.

Provides graphed results along with monthly and yearly amortisation tables showing the capital and interest amounts paid each year. Youll also see your total cost of borrowing including the total interest. Find out more here.

Applications must be received between 31082022 and 30062023 and settled by 30092023. We recommend seeking financial advice about your situation and goals before getting a financial product. Calculate my borrowing power ME N Item - 4 Col c Refinancing.

The extra amount paid and frequency increase reduces the loan term and total interest paid. HELOCs generally allow up to 10 years to withdraw funds and up to 20 years to repay. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be.

Repayment options are the various structures a lender provides for you to repay the borrowed funds. Our Mortgage Repayment Calculator is perfect if youre a first-time buyer looking at remortgaging or if youre planning to move house. This calculator figures monthly truck loan payments.

There are a number of reasons why refinancing could be a great idea - the biggest being financial. To be eligible to apply online you must be at least 18 years of age a permanent resident of Australia applying for. Visit now and explore our calculators.

To talk to one of our team at ANZ please call 0800 269 4663 or for more information about ANZs financial advice service or to view our financial advice. Mortgage Calculator zip file - download the zip file extract it and install it on your computer. For example you can see how increasing your repayment amount could impact on the estimated interest payment and loan term.

The ANZ home loan repayment calculator gives you an estimate of how much you may be able to borrow and what the mortgage repayments could be. Loan must be funded by 30 April 2023. Amortization tables help you understand how a loan works and they can help you predict your outstanding balance or interest cost at any point in the future.

Use our mortgage repayment calculator to get a quick estimate of your monthly payments for your loan. Use our home loan repayment calculator to find out how much your ongoing mortage repayments could be. Loan calculator for English Welsh students to estimate how much they will repay on their student loans applicable to 2012 starters.

Stamp duty differs from state-to-state find out how much you could be up for with our handy calculator. The calculated monthly repayment is either halved and paid towards your loan fortnightly or quartered and paid towards your loan every week. Apply to refinance your home loan with us by 30 September 2022 and settle by 31 December 2022 to receive up to 5000 cashback.

For example upfront fees appear significantly cheaper spread out over a 30-year mortgage compared with a more accelerated 10-year repayment plan. If you retire before the 30 years are up theres a significant. Estimate your borrowing power and more with our home loan calculators.

In the US borrowers usually pay off 30-year mortgages early due to reasons such as home sales. Home Loan Repayment Calculator Loan Payment Calculator. It can also display one additional line based on any value you wish to enter.

This is the best option if you plan on using the calculator many times over the. The loan amount has been calculated based on the information input by you and information sourced by third parties. As assessed by ANZ.

For more on how student borrowing and repayment works watch Martins Student Loans Decoded video. Choosing fortnightly or weekly repayments will in effect give you an extra repayment every year. To help you see current market conditions and find a local lender current Redmond truck loan rates are published in a table below the calculator.

Repayment type can be principal and. By choosing a 25-year loan term instead of a 30-year term your monthly repayments would be 267 higher but you would save 38292 in total loan repayments and in total interest paid over. This amount may not be the final amount you need to re finance your property and is used solely for the purpose of providing you with an indication of the loan amount you may require the upfront costs you may incur.

Rates and repayments are indicative only and subject to change. Try our Mortgage Repayment Calculator and see how much your monthly payments could cost with a market leading mortgage rate. Use Mortgage Repayment Calculator to calculate monthly extra payments amount of interest paid also with offset account on your home loan or mortgage.

The more income you can prove you earn to a lender the greater your borrowing capacity is likely to be. The second tab provides a calculator which helps you see how much vehicle you can afford based upon a fixed monthly budget and desired loan term. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage.

The calculator also doesnt factor in interest rate fluctuations. A home equity loan term can range anywhere from 5-30 years. This is the best option if you are in a rush andor only plan on using the calculator today.

This calculator is for information purposes only and does not provide financial advice.

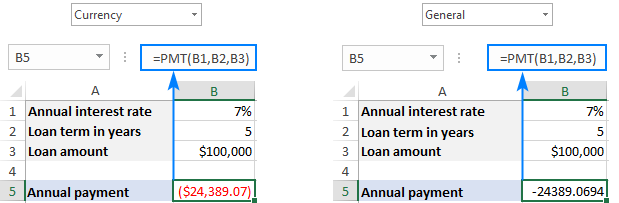

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Excel Ppmt Function With Formula Examples

5 Financial Goals You Should Achieve By Age 30 Forbes Advisor

Is It Possible To Get A Loan For A House Or An Apartment And Then Rent It Out Until It Pays For Itself Even If It Takes Like 20 Years Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Ipmt Function In Excel Calculate Interest Payment On A Loan

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Six Money Challenges To Try This Year Broke On Purpose Weekly Money Saving Plan Money Saving Plan Money Challenge

/what-are-differences-between-delinquency-and-default-v2-dfc006a8375945d4b63bd44d4e17ffaa.jpg)

Delinquency Vs Default What S The Difference

Excel Pmt Function With Formula Examples

30 Bullet Journal Budget Tracker Printable Options 2022

Online Loan Amortization Schedule Printable Home Auto Loan Repayment Chart Online Loans Amortization Schedule Payday Loans

Pin On Lifestyle

A Loan Of 15 Lacs At 10 Compound Interest Vs Same Amount At 14 Simple Interest Which One Is Better For A Repayment Period Of Ten Years Quora

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed